hotel tax calculator texas

A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business. That means that your net pay will be 45705 per year or 3809 per month.

The Independent Contractor Tax Rate Breaking It Down Benzinga

Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax.

. 54 rows 3 State levied lodging tax varies. Local hotel taxes however are due only on those rooms ordinarily used for. A state employee is not exempt from paying a state.

Avalara automates lodging sales and use tax compliance for your hospitality business. Ad Finding hotel tax by state then manually filing is time consuming. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache.

Tax on hotel bill for one 1 day. Failure to comply may. Below is a summary of key information.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 15-012 authorizing the Galveston Park Board of Trustees to be the responsible party for the. Texas Hotel Occupancy Tax Texas Hotel Lodging.

The state hotel occupancy tax rate is 6. Sales tax hotel tax and. Diplomatic personnel of a foreign country who present a Tax Exemption Card issued by the US.

Exemption Photo ID or Tax Exemption Card are not exempt. The tax applies not only to. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more.

Your average tax rate is. TaxAmount 2 Tax Amount 3 Tax Amount 4. Cities and certain counties and special purpose districts are authorized to impose an additional local.

Tax Amount 1. Junction in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Junction totaling 2. And if you live in a state with an income tax but you work in Texas.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295. Determining which taxes apply to a particular hotel charge becomes confusing very quickly. Department of State are also.

To report and pay your taxes you must log in to your account and select the property you wish to report. Please read and adhere to the Hotel Occupancy Tax Reporting Payment Requirements and Exemptions. Total taxessurchargesfees hotel bill.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. Ad Finding hotel tax by state then manually filing is time consuming. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

For State Use and Local Taxes use State and Local Sales Tax Calculator. Hotel Occupancy Tax On February 12th 2015 Galveston City Council passed Ordinance No. Avalara automates lodging sales and use tax compliance for your hospitality business.

The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Texas state rates for 2021. Daily room rate charged by the hotel.

Junction Sales Tax Rates for 2022. Hotel owners operators or managers must collect county hotel occupancy tax from their guests who rent a room or space in a hotel costing 15 or more each day. Take the tax on hotel bill for one 1 day.

TaxesSurchargesFees on hotel receipt. Number of days traveled. Just enter the five-digit zip code of the.

HOW TO CALCULATE HOTEL TAX. This tool is provided to estimate past present or future taxes. Lodging Calculator For prorating.

How To Calculate Sales Tax In Excel

Estimated Tax Payments For Independent Contractors A Complete Guide

How To Calculate Sales Tax In Excel

What Is Hotel Occupancy Tax Texas Hotel Lodging Association

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Vintage The Red W Booklet Advertising Pocket Calculator Etsy In 2021 Vintage Advertisements Pocket Calculators Vintage Ephemera

Texas Sales Tax Calculator Reverse Sales Dremployee

Texas Income Tax Calculator Smartasset

Casio Sl300vcgnsih Solar Wallet Calculator With 8 Digit Display Green Sl 300vcgnsih Best Buy In 2021 Cool Things To Buy Display Casio

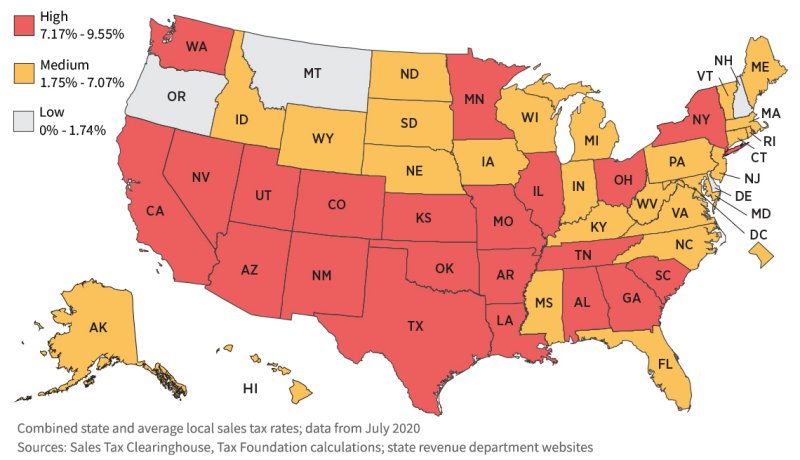

States With Highest And Lowest Sales Tax Rates

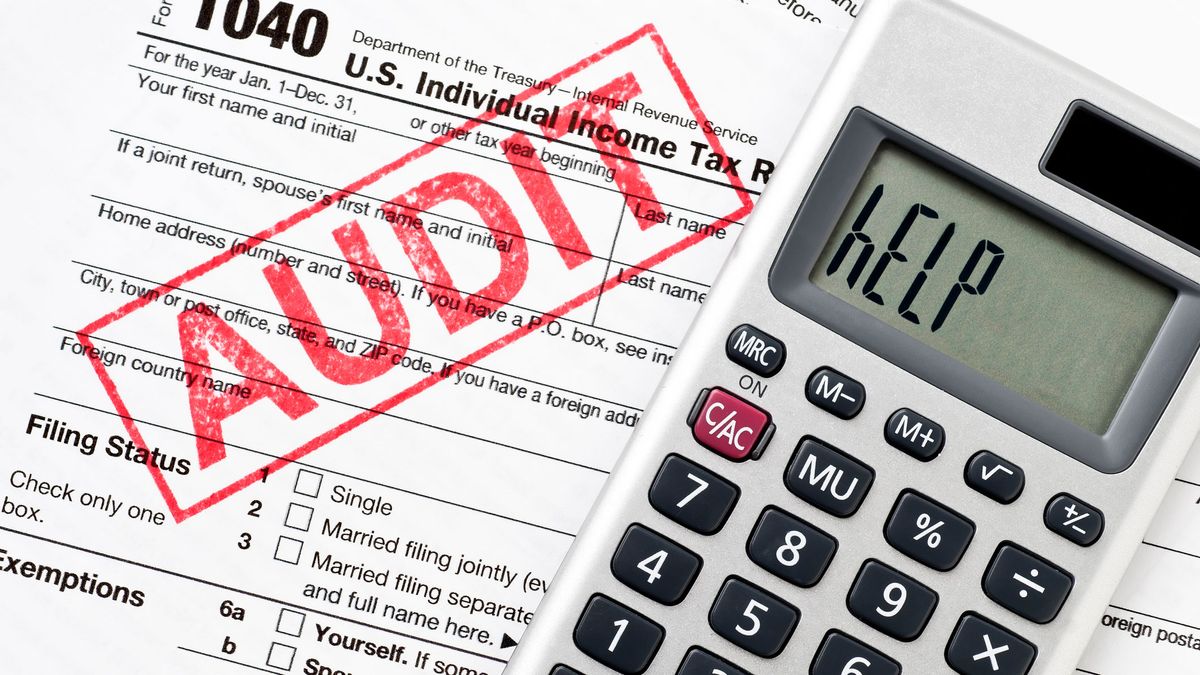

10 Creative But Legal Tax Deductions Howstuffworks

How To Calculate Sales Tax In Excel

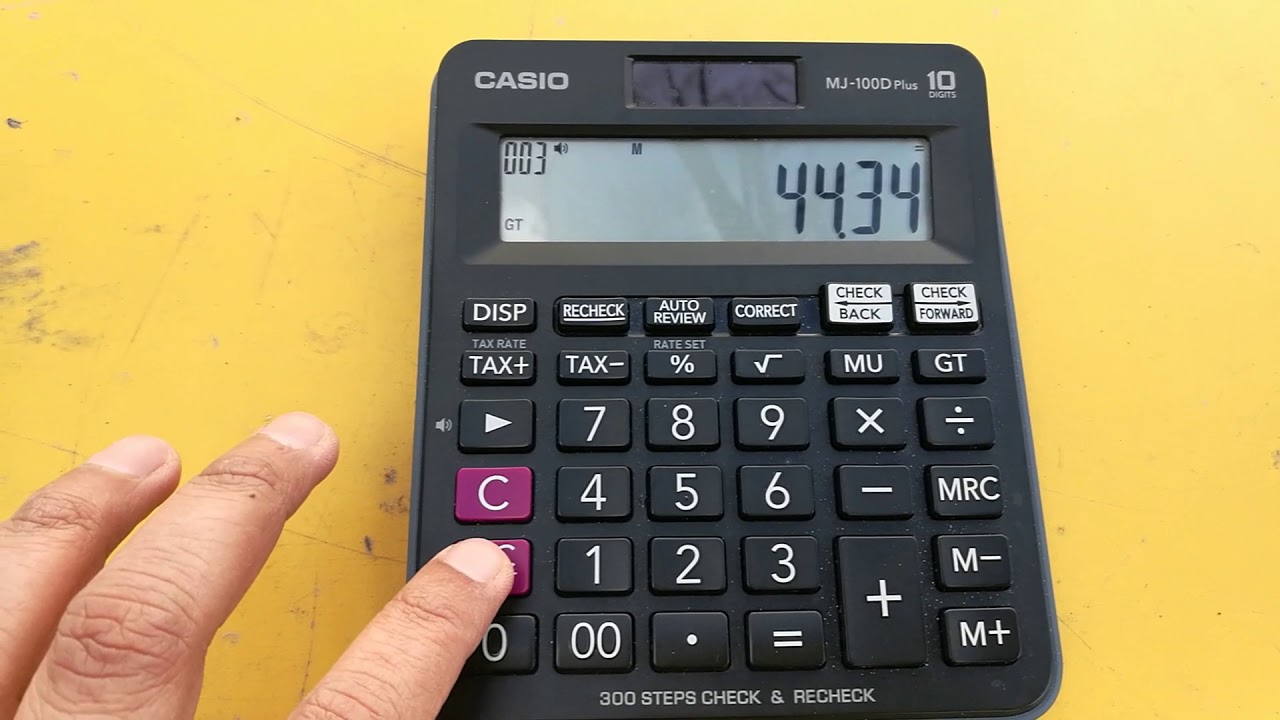

How To Calculate Sales Tax On Calculator Easy Way Youtube

Mortgage Rates Are Now Breaking To New Lower Territory And They Could Stay There For Months Real Estate Estates Rural Real Estate